May is often a month of transitions. As I write this, we are in the process of collecting our youngest daughter from her university, packing up her apartment, and moving her belongings into storage for the summer. Next year, she’ll be in a new apartment, bigger, better, with more amenities and opportunities. Out with the old, in with the new.

This is but one of many transitions she will encounter throughout her adult life. According to the US Census Bureau (2007), the average American moves around 12 times in his or her lifetime. That’s a lot of packing and unpacking!

Moving to a new home can be overwhelming and sometimes downright daunting, whether we’re transitioning from one college apartment to another, or downsizing from a family home to an empty nest condo. Maybe it’s moving up from a starter home to a second home, or the consideration of a rental or vacation property. How we approach these moves makes all the difference in the world.

Here are some pointers for helping you approach your transition with confidence and enthusiasm:

- Prepare. I learned early in my life that “prior proper planning prevents poor performance.” Don’t be that person who starts packing the night before the movers arrive. Start early. Make to-do lists. Delegate jobs for friends and family members. Schedule help and/or the moving company well in advance. If you have small children, arrange for away-from-the-house childcare; animals can go to the kennel for the day.

- Purge. Take this opportunity to get rid of excess possessions you can live without. Decluttering is cathartic—not to mention it makes moving a whole lot easier on your back (and on the friends who help you move!). As soon as you know your move is imminent, start packing away (or giving away) anything you know you won’t be using between now and your move. A great rule of thumb is: if you haven’t used it in a year, it can go. If you have adult children who have moved away, now is the time for them to claim their stuff—or lose it!

- Be Proactive. Where are you headed? Research your new community ahead of time. Have an idea of schools, restaurants, places of worship, community organizations, recreation activities, etc. that appeal to you so you can jump in right away and feel connected as soon as possible. This will help build anticipation toward your new destination, and help alleviate the feelings of loss about your old one.

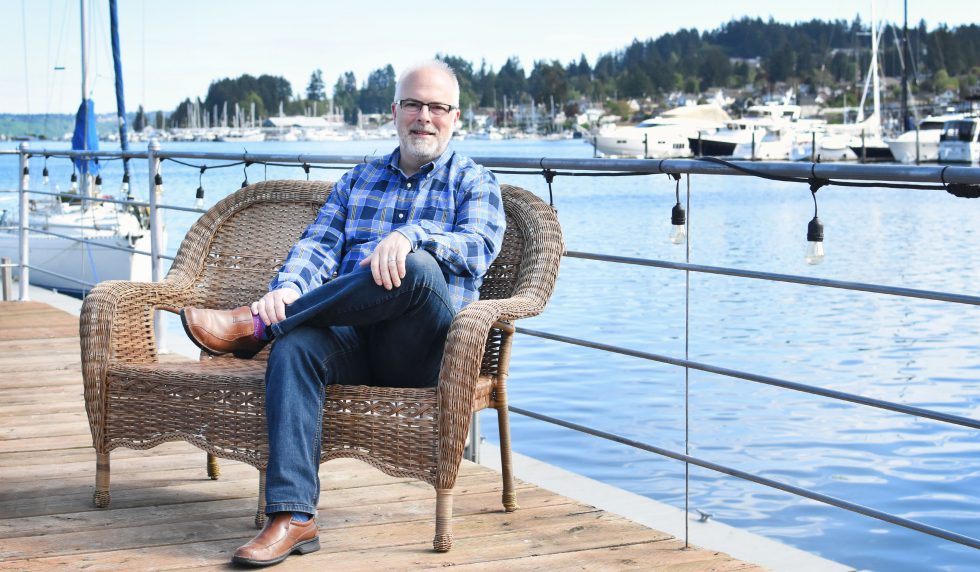

Doug Lawrence is a real estate broker with Keller Williams West Sound in Gig Harbor, Washington. He and his wife have already beat the national average, having moved 13 times in their 34 years of marriage! Every single move has been an adventure in and of itself. Doug’s motto is “Love where you live!” If you’re ready for a transition of your own, he’d be delighted to help make your dream a reality. You can find him at www.douglawrencerealestate.com or dlawrence@kw.com