It all started out as a hope-to, an item I wanted to check off my bucket list: to climb a mountain.

I’ve always thought climbing a mountain was a big, hairy audacious goal that many people talk about but never do. I wanted to separate myself from the pack and be one of the few that do it. So, on July 26th, I had the great pleasure (wait, did I say pleasure?), I mean, I had the great gratification of summiting Mount Saint Helens in Washington State.

I picked Mt. St. Helens as my mountain of choice because it’s a true mountain, achievable with only a moderate amount of gear and training. On the surface, it seems like a moderate-to-hard hike; after all, it is “only” five miles up—two through forest, two across a massive boulder field, and one straight up through loose scree (small, gravelly volcanic rubble). It’s the 8,500-foot elevation gain that really knocks the wind out of your sails and gives you pause to consider (or reconsider) most things in your life.

Looking back down at the one-mile stretch of scree

Looking back down at the one-mile stretch of scree

It’s one of those things that’s hard to explain unless you’ve experienced it, or something like it. All that being said, that moment when you reach the top of the mountain—the cloudless sky, the limitless view, the surrounding peaks, breathing all that in, absorbing it, contemplating it, pondering it—makes the trek more than worth it.

On top of the world (looking down at the lava dome, Mount Rainier in the distance)

Mount Saint Helens is noteworthy for its huge eruption in 1980, and is still an active volcano. Standing on the precipice, looking down at the lava dome with plumes of steam seeping out of it, was magnificent. For me, it was a bit of a full circle, having been nearby in 1980 when the mountain erupted. A high schooler at the time, I had been down in the Longview/Kelso area visiting my brother. I slept obliviously through the eruption, to be greeted on awakening the next morning by swollen rivers, a sky full of ash, and horrific traffic jams of panicked and/or curious residents and onlookers. Nearly forty years later, all that’s just local history. But it was very cool to come back and see how quickly the mountain has repaired itself, its beauty and majesty restored.

Whether you live in the shadow of a volcano as I do, there are adventures to be explored in your neck of the woods, as well. Please comment and share your stories: how do you love where YOU live?

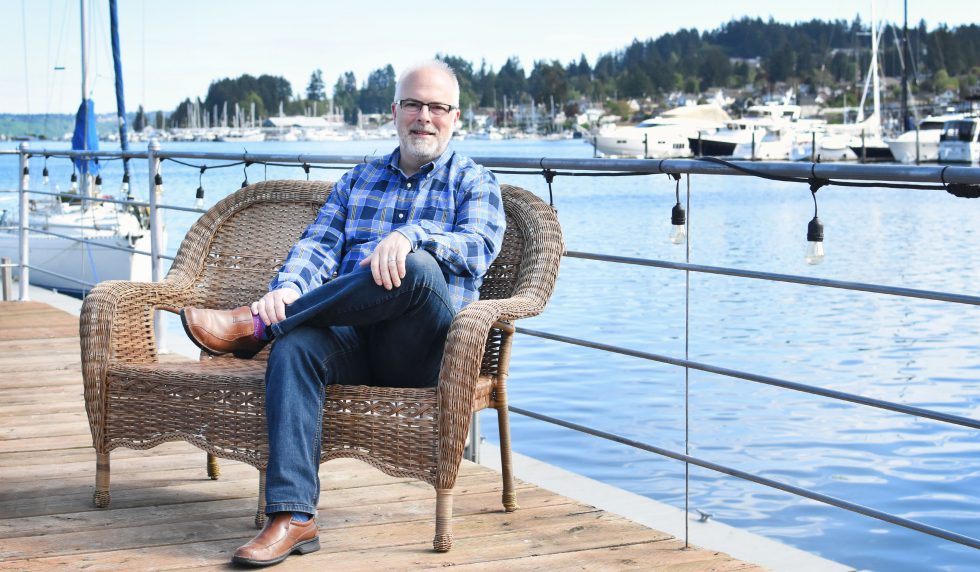

Doug Lawrence is a professional real estate broker with Keller Williams West Sound in Gig Harbor, Washington. Doug’s motto is “Love where you live!” Whether you’re looking to buy, sell, or invest, he’ll put his appetite for adventure and challenge to work on your real estate transaction when he’s not applying it to a mountain. You can find him at http://www.douglawrencerealestate.com or by phone or text at 253.341.5287.

(c) 2017 Doug Lawrence. All Rights Reserved.